How to Pay Income Tax Challan Online ? – I have seen a lot of rush in Banks for paying income tax challan during the first week of every month. After the introduction of Penalty for delay payment of challan has made the thing worst at OLTAS paying branches of banks during such period.

The Income Tax department has made the payment of challan hassle free, as they accept the tax under online mode also. Any Individual, organization etc may pay the Challan under online mode easily. The process is very simple :

Process for Paying Income Tax Challan Online

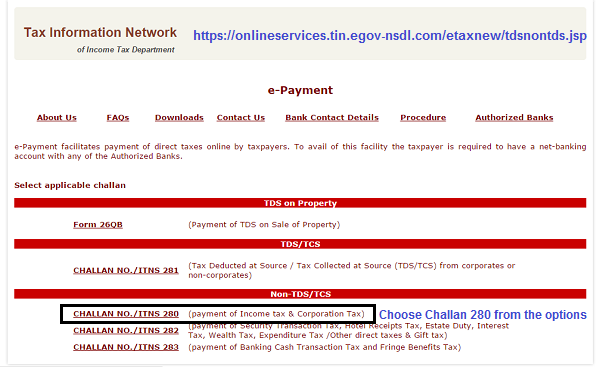

- Go to the Link : https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

2. Click on the link Challan No ITS 280 for Income Tax Payment and 281 for Fixed deposit or others TDS

3. New Link will be opened : https://onlineservices.tin.egov-nsdl.com/etaxnew/PopServlet?rKey=292617228

4. Fill the details as like 0021 for Individual Tax Payers, Assessment year, PAN, Address , Name etc

5. Fill correctly the type of payment i.e 100 or 300 for advance or regular tax

6. Finally the Bank Name for Online Payment of Tax

7. Click on Proceed which will open a new filled form for verification

8. Check the details and click ok

9. Enter your Login detail of bank

10. Fill the Income Tax amount and make the payment

11. Download the challan in PDF format for future.You may download the challan anytime within a year from your bank login page.

This is the simplest approach for Tax payment without rushing and standing in queue at Bank counter. Still If you want to make the payment offline and needed form for Challan 280, Download it Here