File Income Tax Return by 31st July for the current financial year. If you have not filed ITR yet, then do it as soon as possible. According to tax experts, you should take some important precautions while filing ITR. Because if you make a mistake, you may have to face trouble. Today we are telling you about 8 such things that you should keep in mind while filing Income tax Returns.

Choose the correct ITR form

Key Highlights :

The Income Tax Department has prescribed several ITR forms. You have to choose your ITR form carefully based on your source of income, else the Income Tax Department will reject it and you will be asked to file a revised return u/s 139(5) of Income Tax.

Provide correct income information

Always give accurate information about your income. If you intentionally or accidentally do not disclose all your sources of income, then you may get notice from the Income Tax Department. Information such as savings account interest and house rent income is also to be given. Because these incomes also come under the tax net.

Choose the right option for you between the old and the new tax regime

Taxpayers get two options to file income tax return. The new option was given on April 1, 2020. In the new tax slab, the tax rates on income above Rs 5 lakh were kept low, but the deduction was taken away. On the other hand, if you choose the old tax slab, then you can take advantage of many types of tax deductions.

Non filling of bank account details

Many people do not give details of all their bank accounts with which they have done transactions in that financial year. It is wrong to do so, as the Income Tax Department has clearly stated in its Act that it is mandatory for the taxpayers to give details of all the bank accounts registered in their name.

Download Form 26AS and tally your income with it

Form 26AS or Tax Credit Statement gives all the details of payment of TDS deducted on your income. Be sure to check this before claiming your tax refund. The taxpayer is asked to reconcile the income from Form 26AS and Form 16/16A before filing the income tax return. This will save you from any mistake in tax calculation so that you will be able to file a correct tax return.

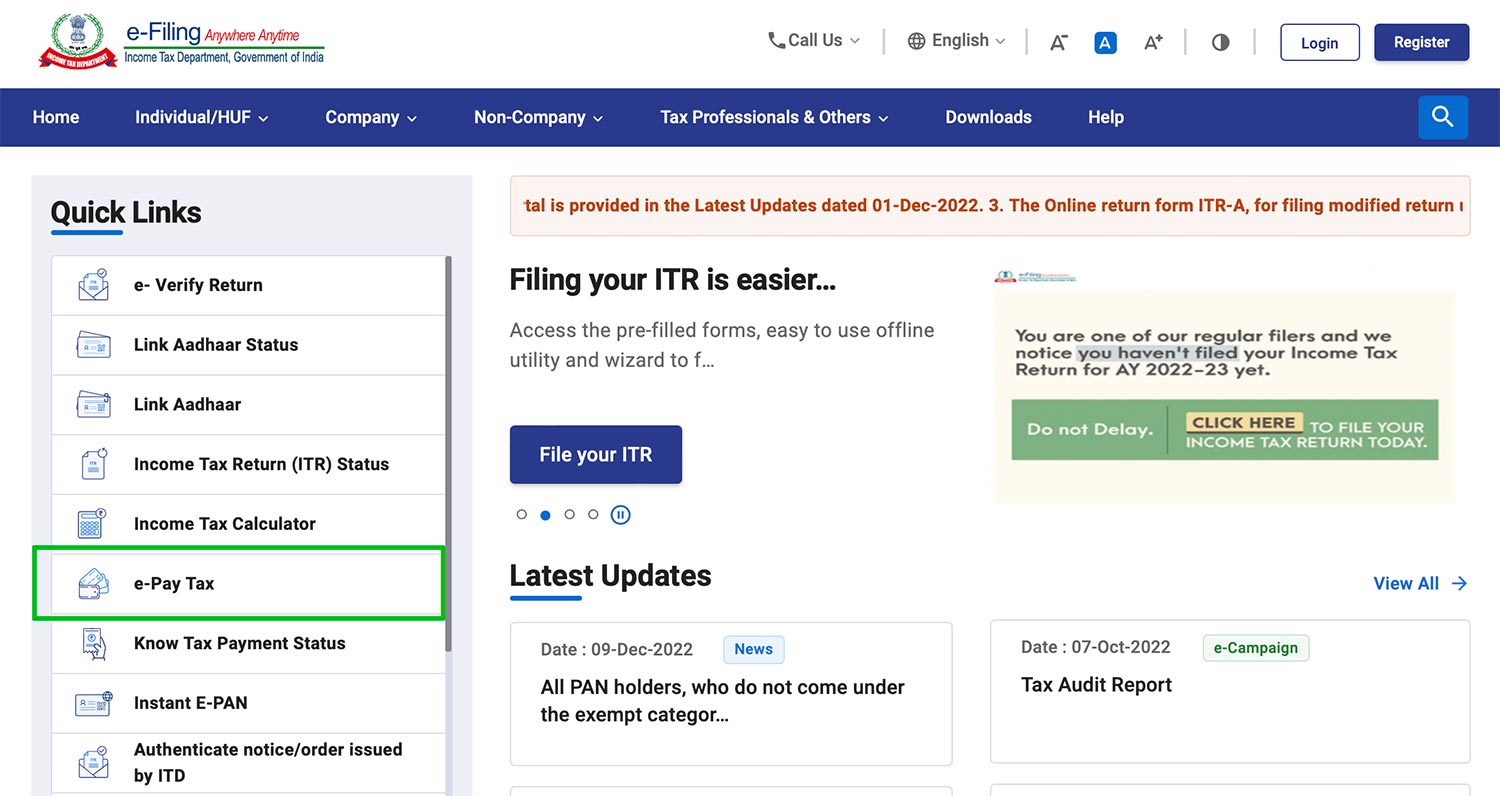

Verify tax return

Many people think that after filing the tax return, their work is over, but after filing the tax return, you have to verify it too. You can e-verify your tax return from your income tax e-filing portal or you can also get it verified by sending it to CPC-Bangalore.

Also Know – Check Income Tax Calculation For Salaried Employees in FY 2022-23

Give information about the gift received on festival or any other occasion

According to the rules of income tax, if you have received a gift worth more than 50 thousand rupees in a year, then you will have to pay tax on it. In such a situation, you have to keep this in mind while filing income tax return.

If there is a bank account abroad, then it is necessary to give information about it too.

If you have a bank account in any other country, then you also have to give this information while filing income tax return. As per income tax rules, all tax payers in India will have to provide details of all foreign assets including bank accounts. If you have investments in stocks or mutual funds abroad, be careful while filling the details…the tax calendar by Income Tax