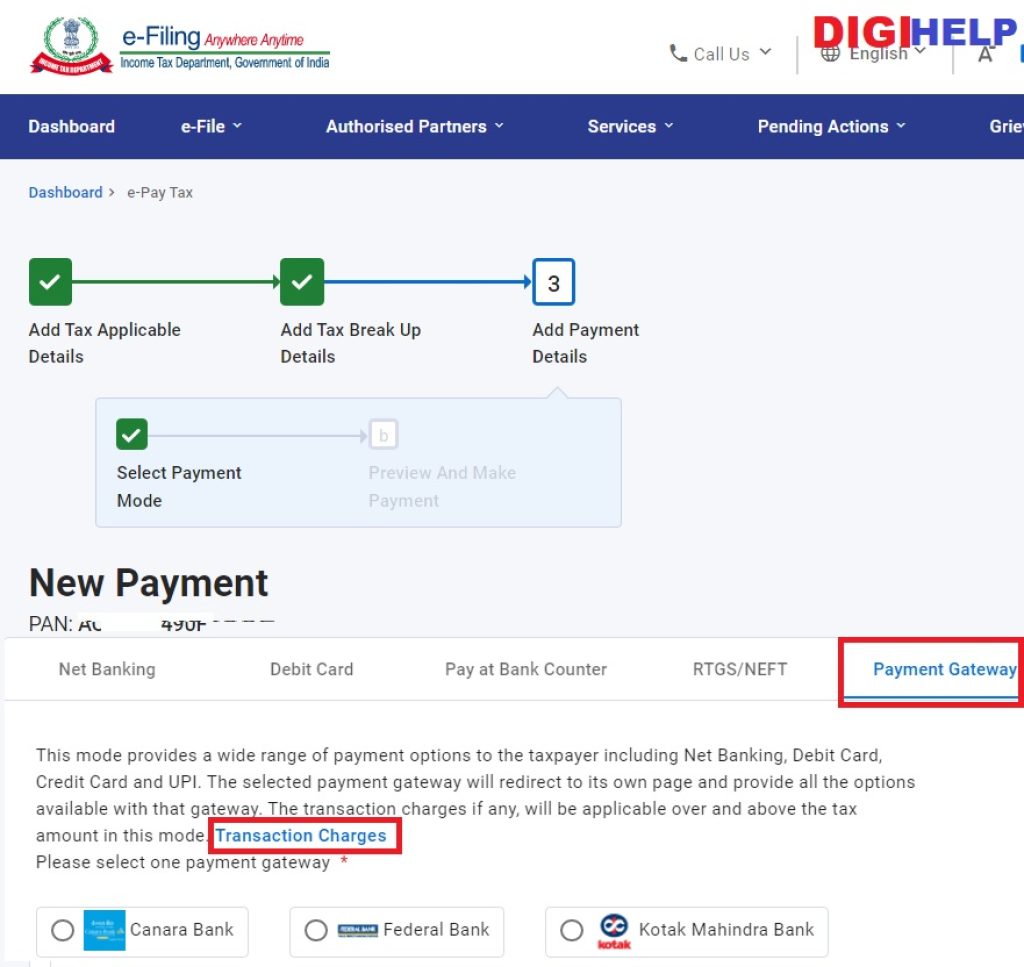

Know the simple steps to pay Income tax with Credit card in India. Income Tax department has enabled the acceptance of Income Tax, Advance Tax or TDS through Credit card via online payment gateway at Income tax India efilling portal. The process is simple and easy and payment can additionally be made through UPI, Debit Card & Online Banking. Currently, this services are provided by Canara Bank, Federal Bank & Kotak Mahindra Bank. Out of three, the Canara Bank is having the lowest PG transaction charges.

Steps to Pay Income Tax With Credit Card

- Click on IncomeTax eFiling Portal

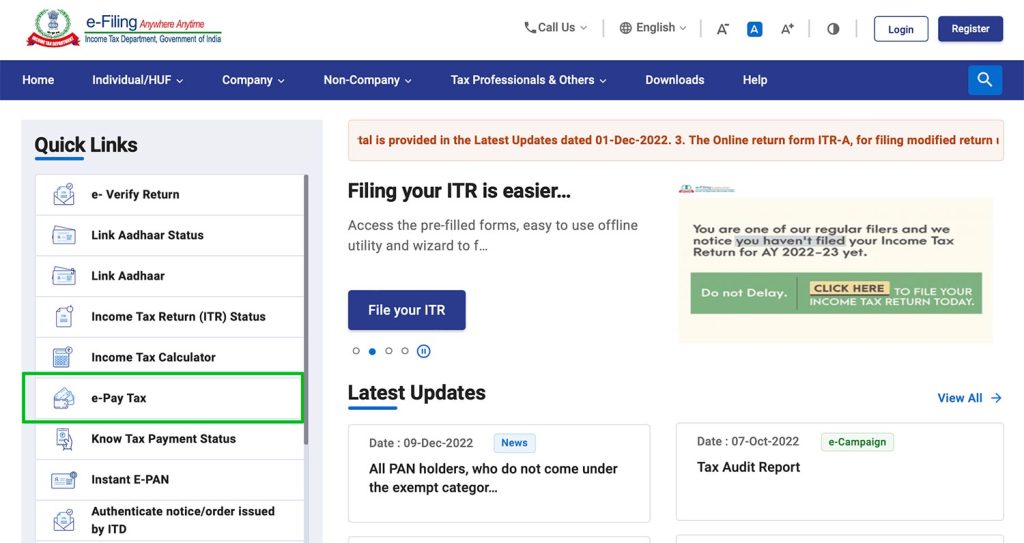

- Go to “e-Pay Tax” section under eFile Tab post Login

- Or Choose option e-Pay Tax from the left menu without login

- Enter your PAN/TAN details

- An OTP will be sent on the registered mobile number

- Choose type of tax, then select FY/AY & other details

- Select the “Payment Gateway”

- Choose Credit Card option and provide details

- Make the final payment

Also Know – Should I Apply for Canara Bank Credit Card ?

Note : Choose the payment Gateways based on the transactions charges. All banks are having different charges for making payment through PG. The details about the bank charges are mentioned in the link ‘Transaction charges’ at bottom. The Canara Bank is having the list PG charges with 0.47% of the transaction amount, which is lowest.