Check Fake Income Tax Returns (ITR) – Verifying the Income Tax Returns (ITR) is an important criteria for assessing the loan application of any customers/borrowers by Loan officers or Branch Managers in any of the Banks i.e. Public Sector Bank or Private Banks. Many a time Bank officials or Credit or Loan Officers finds it difficult to verify the genuineness of the ITR submitted by borrowers for assessing the income criteria hence lack in due diligence.

Read – How To Check Whether Your TDS is Actually Going to Government ?

There are various ways to verify the ITR submitted by borrowers for getting any type of Loans. In order to curb the menace of fake ITR, bank officers must insist the borrowers to submit the proper acknowledgement with CPC reference number. These details are being generated only after physical submission of ITR-V to CPC Bengaluru with in 120 days of e-filing.

There are multiple way for authenticating the Income Tax ITR either offline or verify the ITR-V status online. Just follow the below mentioned steps :

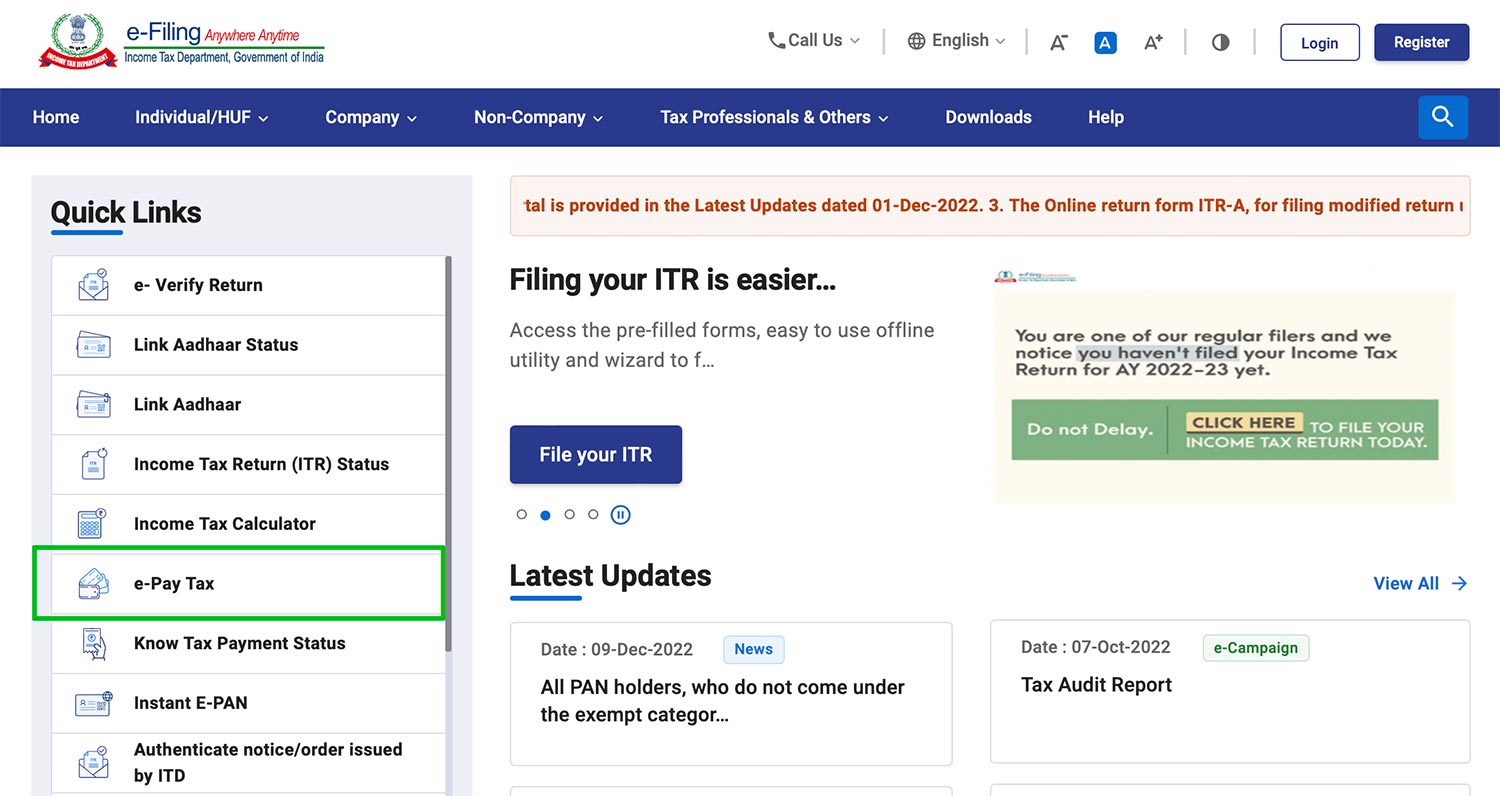

- Visit the Income Tax Official link after Clicking Here

- Provide PAN number and e-Filing Acknowledgement number

- Add Captcha Code

- Submit

Post successful validation the following reports will be generated, when you give the PAN and other Details you will get the ITR-V submission status in following ways:

Read – How To Calculate Tax on Share & Stocks Income ?

- When return is not filed, you will get the status as “No return has been filed for this PAN and assessment year or e-filing acknowledgement number”

- When return filed and it is digitally signed then you will get the status as -“E-return for this assessment year or acknowledgement number is digitally signed”

- When return filed and it is NOT digitally signed then there are two possibilities

- ITR filed online but signed acknowledgment is NOT received by Income Tax Department – CPC, Bangalore – You will get the status as ITR-V not received

- ITR filed online but signed acknowledgment is received by Income Tax Department – CPC, Bangalore – You will get the status as ITR-V received

- It is also advisable to verify status of ITR–V on PAN as well as e-filing acknowledgement number basis. As return many be filed but acknowledgement many be fabricated.

The given web link only verify the PAN and acknowledgement number but no data (like gross total income, taxes paid, etc,). If PAN and acknowledgement number is correct, but other data of the ITR-V is fabricated, then it is not possible to track such fabrication in this verification method.

Additionally Bank Officials may verify offline after following the below steps:

- Confirm that last six digits of acknowledgement number is date of filing return, as mentioned on the acknowledgement.

- Check bar code carefully, the first 10 characters is the PAN, also check bar code also contain 15 digits acknowledgement number.

- Banker can also cross verify the contents of ITR-V with tax challans and TDS certificate.