List of New Income Tax Rules – Due to Demonetization and government drive against black money, a lot of Income Tax rules are either amended or changed with change in financial bills. Here are the list of major Income tax rules which are changed and implemented by next financial years are :

Read : How Will GST Impact Common Man Pocket ?

Change in Income Tax Slabs

1) Existing Income Tax slabs rate are changed to newer one. The tax rate on income between Rs. 2.5 lakh and Rs. 5 lakh will be 5 per cent from 10 per cent.

(Download Income Tax Calculator FY 2016-17 in Excel For Government Employees)

Tax rebate under 87A changed. Rebate under Section 87A gets reduced from Rs. 5,000 to Rs. 2,500. No further rebate will be applicable for taxpayers having income above Rs. 3.5 lakh.

This means tax savings of up to Rs. 7,700 for those with a taxable income between Rs. 3 lakh and Rs. 5 lakh. Where as tax saving odf Rs 12,900 for persons with taxable income between Rs. 5 lakh and Rs. 50 lakh.

(Calculate & Download Income Tax Calculator FY 2016-17 in Excel For Government Employees)

2) Individual having income more than Rs 50 lacs to Rs one crore , A surcharge of 10% will be charged. Where as existing surcharge of 15 per cent will remain the same for individuals having income above Rs. 1 crore.

(How to reply Non Compliance Income Tax notice?)

3) A simplified Income tax return form for person having only salary income. This return form will be utilized for individuals having a taxable income up to Rs. 5 lakh other than business income.

4) RGESS (Rajiv Gandhi Equity Saving Scheme) discontinue from Assessment Year 2018-19. No deduction will be allowed for investment in RGESS.

5) Modification in Income tax rules gives Income tax officials power to reopen tax cases for up to 10 years if search operations reveal undisclosed income and assets of over Rs. 50 lakh.

6) Introduction of Penalty for non filling Income Tax returns – Income Taxpayers who do not file their returns on time will have to shell out a penalty of up to Rs. 10,000 from Assessment Year 2018-19. However, if the total income of the person does not exceed Rs. 5 lakh, the fee payable under this section shall not exceed Rs. 1,000.

7) Capital Gain tax benefit time period reduced from two years, from three years. This will help save tax if a property is sold within two years of buying. The profit from the transaction will be treated as short-term capital gains and will be taxed according to the slab rate applicable to him/her.

8) Tax cut on Self owned properties let out on rent. As per existing Income Tax rule, for properties rented out, a borrower could deduct the entire interest paid on home loan after adjusting for the rental income. In case of rented properties, the borrower can claim a deduction of up to Rs. 2 lakh per year after adjusting for the rental income and all the amount above Rs. 2 lakh can be carried forward for eight assessment years.

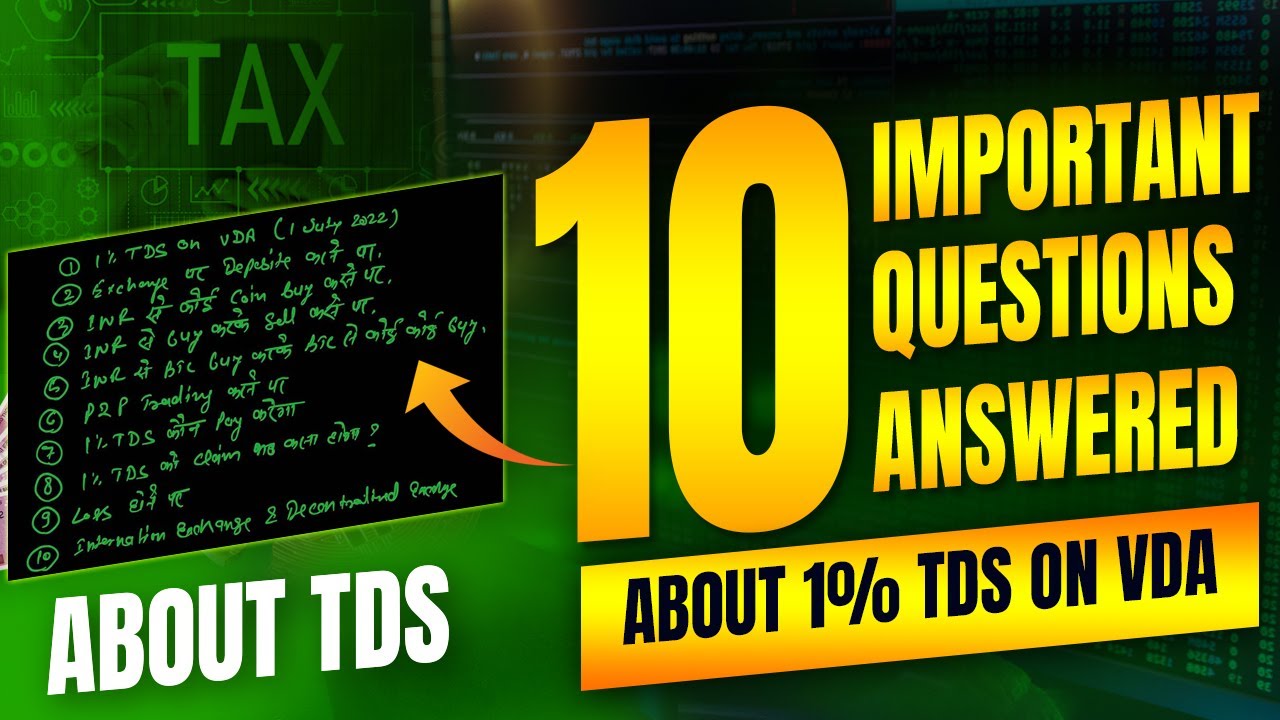

9) There is a provision of 5% TDS Income Tax for rental payments above Rs. 50,000 per month. It will be effective from June 1, 2017.

10) Relief for NPS holder. Partial withdrawals from National Pension System (NPS) will not attract tax. NPS subscribers can withdraw 25 per cent of their contribution to the corpus for listed emergencies before retirement. Withdrawal of 40 per cent of the corpus is tax-free on retirement.

(How To Transfer Funds To NPS Account ?)