Investors are worries because their stocks are moving down at sensex, but all such investors who had invested in Gold ETF are smiling because of higher prices of GOLD which is moving up on each day of trading.

Gold ETF is not a new term for investor now.

What is Gold Exchange Traded Funds Gold ETF’s ?

Gold ETFs are open-ended mutual fund schemes which invest the money of investors in standard gold bullion (0.995 purity). Gold ETFs buy standard gold (99.5% purity) and place it with custodian banks for safekeeping. The investor’s holding will be denoted in units, which will be listed on a stock exchange.. Against this gold, units are issued, which are equivalent in value to about 1 gram of gold.

These units may traded in the stock exchange like any other share traded on Stock market. An investor can redeemed it’s unit any time at stock market.

How Does GOLD ETF Calculation Work ?

Gold ETF calculation work on very simple mathematics. For example, under Benchmark Mutual Fund’s scheme, the units are allotted in the value of one gram of gold. Like if you invest Rs 10,000, when the price of 10 gm of gold is Rs 9,650, he will be allotted 10.20 units (Rs 10,000 – 1.5 per cent entry load / 965).

Here Entry load varies according to type of ETF of various companies like UTI, Reliance Gold, SBI Gold, KOTAK Gold ETF etc.

Why To Choose Gold ETF Fund ?

Due to weakening of World’s strongest currency Dollar, it’s safe to invest in Gold because this yellow metal is traded and accepted all over the world with equal value. Other benefit for Gold ETF are :

1. It is easier to hold gold without risk.

2. There is no wealth tax since it is traded like physical gold. Income from units of gold ETFs is exempt from tax.

3. The purchasing power of gold remains constant irrespective of the situation.

4. Gold prices are always at upward with long-term capital gains at 20 per cent on an average.

5. You can also borrow from a bank against gold BeES (Benchmark Exchange Traded Scheme)

How To Trade in GETFs ?

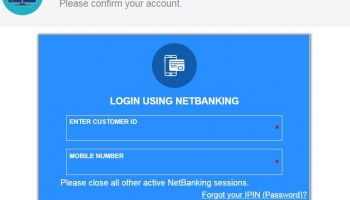

There are two way to invest in Gold ETFs, either through DMAT account or buying the unit as like other mutual funds. Open DMAT account with any of the brokerage firm like Sharekhan, Angel broking etc. and trade it like any other share trading.

If you want to buy GOLD ETF like any other mutual funds scheme you may buy it like reliance ETF, KOTAK ETF, Sundaram GOLD ETF etc. through their websites or by calling them on their customer care. You may opt for monthly, half yearly, one time etc option to invest in Gold ETF.

Do remember that each Gold ETF has it’s own Entry load.

List of GOLD ETFs Indian Market

There are eight gold ETFs currently listed on Indian stock market with a total collection of more than 15 tonnes.

– It is said that the India’s gold ETF collection is small compared to its approximately 700 tonnes of annual gold consumption. But industry players suggest it could rise by at least 50 per cent year-on-year.

– Benchmark Mutual Fund, owned by Goldman Sachs Asset Management, was the first to start a gold ETF in 2007 and has the largest collection of more than eight tonnes.

– The ETFs are listed on India’s National Stock Exchange and Bombay Stock Exchange and most of them have a minimum individual share size of one gram.

| Gold ETF Fund | Launch Date |

| Gold BeES | March 2007 |

| UTI Gold ETF | April 2007 |

| Kotak Gold ETF | July 2007 |

| Reliance Gold ETF | November 2007 |

| Quantum Gold ETF | February 2008 |

| SBI Gold ETF | May 2009 |

| Religare Gold ETF | March 2010 |

| HDFC Gold ETF | July 2010 |

| ICICI Gold ETF | August 2010 |

| Axis Gold ETF | November 2010 |

| Birla Sun Life Gold ETF | May 2011 |