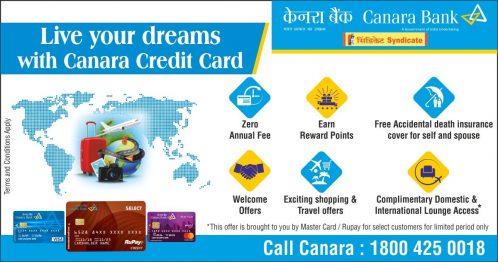

Canara Bank Credit Card Review, Features & Reward Rate

- Life time free credit card

- Free Domestic Lounge Access

- Reward Point for Statement credit

- Easy EMI

- Lower Processing Charges

- Lower EMI ROI

- Separate Mobile Application

Canara Bank Credit Card Review, Features & Reward Rate – There are very few Credit Cards which are offered by Public Sector Banks are popular in the market except SBI Cards. Recently I had applied for the Canara Bank Credit Card and It was approved and delivered within 14 days hassle free. After using the credit card for a week, I thought to share the experiences of Canara Bank Credit Card.

I had applied for the Canara Bank Rupay Select Credit Card as I wanted to go for a change from the existing variant of VISA and MasterCard. Though the offering on Rupay enabled Credit Card are not much, still I thought to have a one. The main attraction with Canara Bank Credit Card is lowest EMI and Processing Fees on outstanding bill conversion.

Joining Fees & Charges

Key Highlights :

| Fees & Charges | Amount |

| Annual Fees | NIL |

| Joining Fees | NIL |

| Inactivity Fees | Rs 300, if the annual minimum transactions is less than Rs 10,000 |

| Cash Withdrawal Fees | 3% of the transaction amount subject to minimum Rs 30 for every Rs 1000 and part thereon |

| Revolving Facility | 2.5% per month |

| Cash Withdrawal Limit | Max. Rs 50,000 per billing cycle |

Reward Points

You earn 2 reward points on Rs. 100, on all retail* spends including Insurance, Utilities, Education and RentPay. One Reward Point equivalent to Rs 0.25. Encasement is available for the reward point against the bill.

Default Reward Rate

- 1 Reward Point = 0.25 INR

- 2 RP for every 100 INR Retail, Online, Offline Spends

- Reward Rate: ~ 0.50%

Spend Based Milestones

- No Such accelerated reward program

The reward rate is not as competitive like other cards in the market like Flipkart Axis Credit Card or SBI Ola Credit Card or even Ragila First Credit Card, which are offering reward rate of 1.5%, 1% and 0.80% respectively. But the best part is that encasement is available for the reward point against the bill.

Redemption

The reward point can be redeemed against statement credit.

Lounge Access

Domestic

- 2 complimentary lounge access per Qtr within India

Other Benefits

- Zero lost card liability post reporting

- Personal Accident insurance coverage

- Rs 10 lakhs insurance coverage without any Premium

- Various offers as provided by NPCI : Click Here

- Easy EMI Conversion through Mobile App

How to Apply for Canara Bank Credit Card

Canara Bank is offering Credit Card with minimum limit of Rs 10,000 to Maximum of Rs 25 Lakhs. The existing housing loan, business and high net worth customer may get it easily as it falls under pre approved categories. The overall limit will be fixed on various criteria as like CIBIL score, past credit history, existing loan repayment etc. The erstwhile Syndicate Bank customers can also apply and get the Canara Rupay Select Credit Card.

If you are the existing customer of Canara Bank or Syndicate Bank with good track record with the bank, getting the credit card is much easier and hassle free. Just visit and apply for the Credit Card at your branch or alternatively apply online.

Canara bank is also offering the credit card even against the deposits also. If you are not having any credit history or applying for the credit card first time, you may get it against the deposit. Bank is offering credit card with 75% limit of the deposit. The variant of the card will be different than Rupay Select Credit Card.

Also Read – How To Pay Canara Bank Credit Card Bills Online ?

Canara bank is offering the credit card to their existing account holders only. The process for getting the Canara Credit Card is easy. Follow the below steps :

- Visit the Canara Bank Internet Banking & login page with User ID and Password, you may click on link

- After login, go to the Credit Card Apply Online link and submit your interest.

- Done ! You will get the call from the bank for the details and checking the eligibility criteria.

- Alternatively, you may also apply after visiting the home branch where you are already having an account. Syndicate Bank customer may visit their home branch where they hold the saving/SOD/Current/loan account.

- Apply to the branch after filling the application form.

- Post assessment, credit card will be sent on your registered address within 14 days.

Also Read – Credit Card to Bank Account, How to Transfer Fund ?

Bottomline – Canara Bank Credit Card Review

Though the Canara Bank Credit Card is not popular for higher offering and discounts but It’s is good in term of value. There are no charges like Joining, Renewal or annual fees on cards and best part is no hidden charges. In term of value, the Canara Bank Credit Cards are offering the cheapest Interest Rate on EMI conversion and lower processing fees. The reward rate of 0.50% is though lower but can be adjusted against the statement credit. The best part is free lounge access in life time free credit card. No LTF credit cards are offering free lounge access.

They are also having the separate Android and iOS based Mobile app for easy view, paying and converting the bills to EMI. I even didn’t find the separate mobile app for credit card with HDFC bank also.

Customer Care Support – 1800-425-0018

Cheap processing fees and no annual or joining fees. Processing charge is also low. Decent Credit Limit. I simply love it.