Check the Transaction Limit of PNB ATM Card – Public sector Punjab National Bank (PNB) has revised its debit card transaction limit. The daily ATM cash withdrawal limit for VISA Gold debit cards as well as platinum MasterCard and Rupay cards would increase to Rs 1 lakh from the present limit of Rs 50,000.

The daily ATM cash withdrawal limit for VISA Gold Debit Cards of PNB would now go up to Rs 1 lakh from Rs 50,000, while the daily POS limit would be hiked from Rs 1,25,000 to Rs 3,00,000.

The ATM cash withdrawal cap for Rupay Select and Visa Signature debit cards would be Rs 150,000 from the existing Rs 50,000. The daily limit on POS transactions for these cards would rise from Rs 125,000 to Rs 500,000.

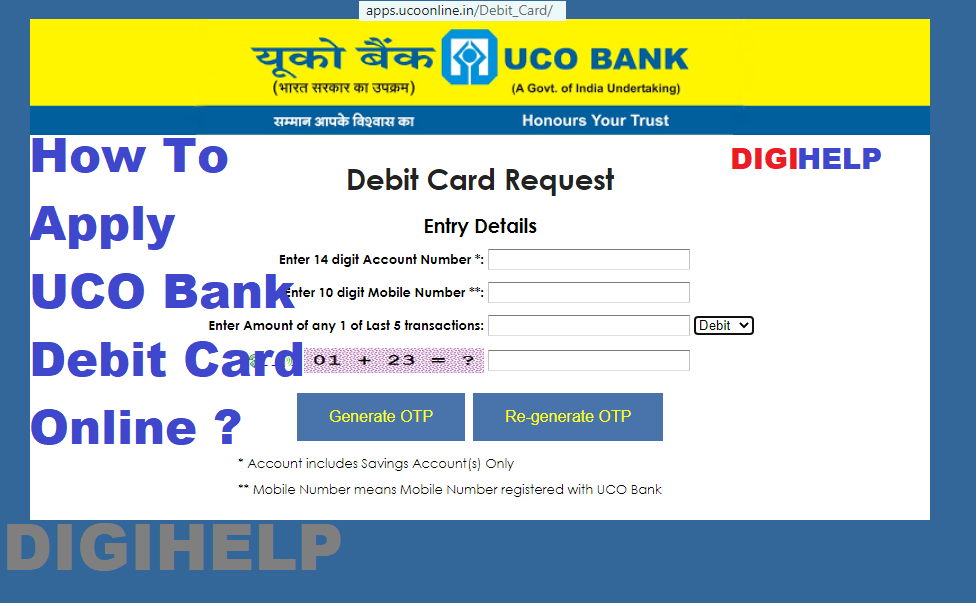

Customer of PNB with online banking access are advised to set their customized limit through Internet banking or PNB One mobile banking app, PNB ATM, IVR, or by visiting the home branch.

Also Know – How to Enable Debit Card in PNB Online ?

Withdrawal Transaction Limit of PNB ATM Card

Key Highlights :

The current daily cash withdrawal limit for PNB Bank customers is Rs 25,000, while the one-time cash withdrawal limit is Rs 20,000. The daily POS transaction limit for PNB customers is Rs 60,000. This limit, however, only applies to bank-issued Rupay and Master Classic Debit cards.

Besides, there is a Rs 50,000 daily cash withdrawal cap for PNB customers. Those who own a Gold Debit Card issued by Visa, the daily and one-time cash withdrawal limits are Rs 125,000 and Rs 20,000, respectively.

How to Fix Debit Card withdrawal limit ?

- Download Mobile Banking of Punjab National Bank i.e. PNB One

- Log in to PNB One

- Select the debit card icon and click on the ‘Update ATM Limit.’

- Select the account number from the dropdown menu.

- Under debit card authentication, select their debit card number from the dropdown menu.

- Fill in the expiry date, year and PIN.

- Clicks on ‘continue’, the screen will show the current limit.

- For the new ATM withdrawal limit, customers have to log in and click on continue.

- To confirm the request, the customer has to enter the OTP.

- Once done, the bank will update the request in real time.