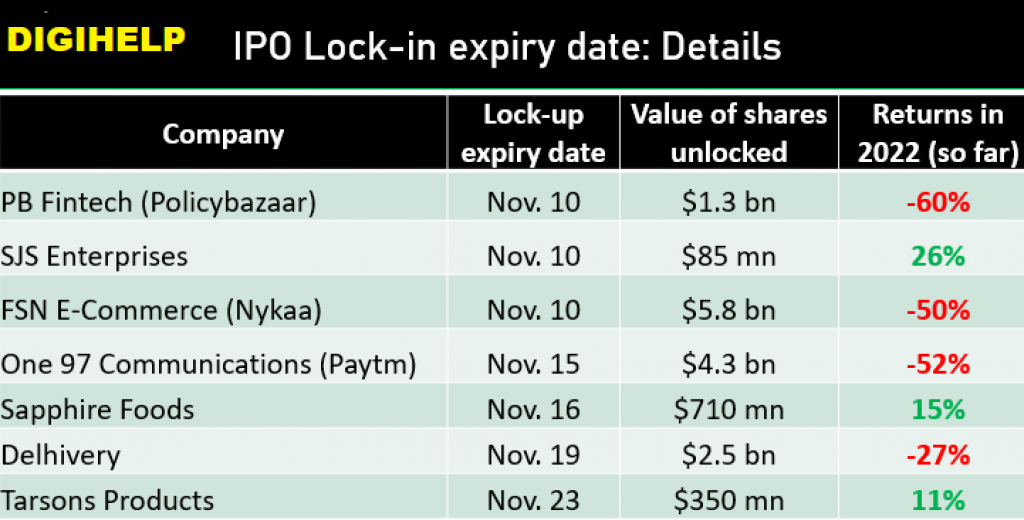

Why Do Nykaa, Paytm, Policybazar & Zomato Share Price Falling ? The share prices of the new age fintech stocks like Nykaa, Paytm, Policybazar & Zomato are falling and continued to remain under pressure in future as predicted by the numerous investors. According to analysts, the lock-up period on $14 billion worth of shares sold in initial public offerings of these stocks are expiring in next few weeks. This will allow major investors such as Warren Buffett and Masayoshi Son to sell their stakes. The table below shows the lock-up expiry date, and the return the stock has given in the year so far.

What is Lock-in Period in Stocks?

As per existing SEBI guidelines mandate the minimum requirement of 1-year lock-in period for pre-IPO investors when these companies got listed. That lock-in for at least 11 companies ends in the next few days, and hence it is feared that leading investors will dump all or part of their holdings in the market. Leading investors, the likes of Warren Buffet and Masayoshi Son, who had made pre-IPO bets in these companies, are expected to exit or sell part of their holdings as reported by the various media sources.

Also – Know Trading Volume Analysis for Buying Stocks

Why is Paytm Stock Falling ?

Key Highlights :

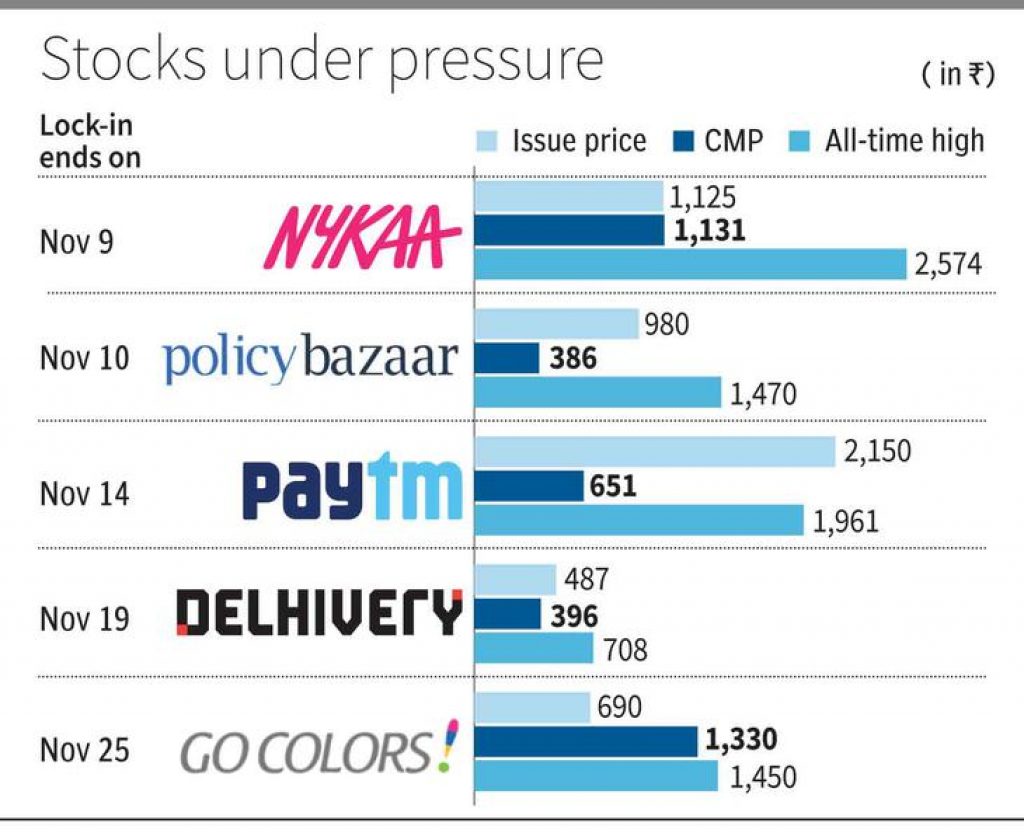

Know the reason why is Paytm Share Price Falling ? Paytm has lost more than 70% of its value since its IPO, which was backed by global investors including SoftBank Group Corp, Warren Buffett’s Berkshire Hathaway Inc. and Jack Ma’s Ant Group. Analysts say that the stock may come under pressure after Nov. 15, as $4.3 billion worth of shares get unlocked, giving the investors an exit route.

Why is Policybazaar stock Falling ?

Interestingly Policybazaar has lost nearly 60% stake in the year so far, while Delhivery is down 27%. Softbank was an early investor in Delhivery and PolicyBazaar owner PB Fintech as well.

The share price of Paytm, listed under the name One 97 Communications, is down 70 per cent from its IPO price. The company was backed by global investors including Son’s SoftBank Group Corp., Buffett’s Berkshire Hathaway Inc. and Jack Ma’s Ant Group Co.

Policybazar, or PB Fintech, is down 60 per cent from its IPO price.

Zomato Share Price Falling down by 15 percent from its IPO price, and the stock has more than halved from its high of ₹169.

The share price of Nykaa or FSN E-commerce Ventures is hovering near its IPO price of ₹1,125 but has crashed badly from its high of ₹2,574.