Canara Bank Credit Card EMI, Interest Rate & Eligibility

- Lower Rate of Interest

- Lower Processing Fees

- Easy conversion through App

- Flexible repayment period

- No other hidden charges

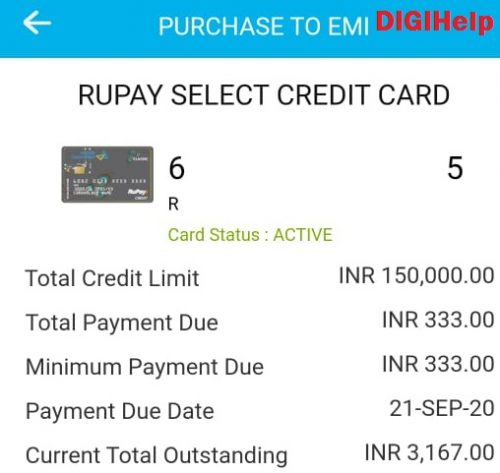

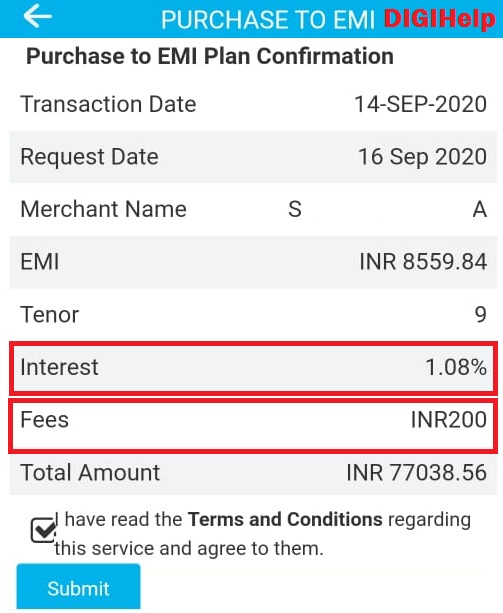

Canara Bank Credit Card EMI Facility & Interest Rates on conversion – Step by step process to convert the outstanding of Canara Bank credit card bills in easy EMI with cheapest Interest rate. The Rate of Interest on Canara Bank Credit Card EMI is as cheap as 1.08% Monthly or 12.96% annually. The processing fees is just Rs 200/-, and no pre payment charges on early closure of the Credit Card Loan.

Canara Bank is offering the Credit Card with limit up to Rs 25 lakhs based on various eligibility criteria. Bank is offering various variants of Credit Cards like VISA, RUPAY, Mastercard etc. Majority of the Canara Bank Credit Cards are coming up with No Annual charges & No Joining Fees.

Canara Bank Credit Card EMI – How to Convert Outstanding Bills ?

Key Highlights :

In order to convert the outstanding purchases of the Canara Bank Credit Card to EMI, It is mandatory to download and install the ‘Canara Saathi’ app. The Application may be downloaded from the Android play store or iStore [Click for Android] [Click for iStore].

NOTE : This is to remember that the ‘Purchase on EMI’ tab will be disabled temporarily on monthly billing generation date (i.e. 20th of each month for Rupay card). The EMI conversion link will be disabled before 48 hours of Statement Generation date (i.e. 1st October in Rupay). So you need to convert the EMI within the residual period.

Follow the below steps to convert the existing bills to EMI.

1. Open the Canara Saathi App, Register and click on the menu option. Choose the option “Purchase to EMI”. If not registered, follow the below steps.(Click on options. Three lines on top left corner. )

2. Click on Convert option, to initiate Purchase to EMI for any specific eligible transaction.

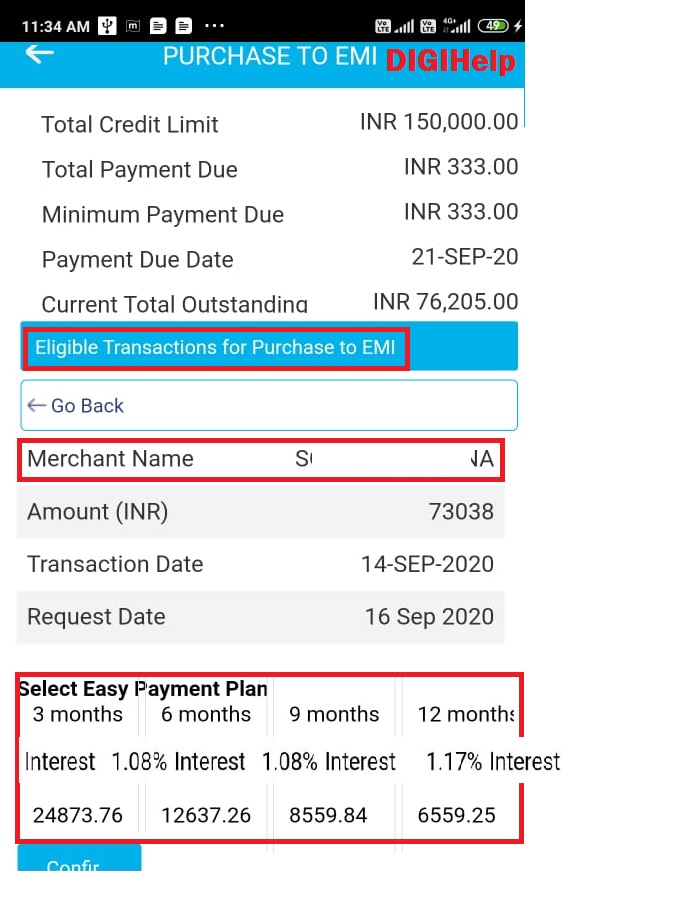

3. After clicking on Convert option, the page is navigated to second Screen of Purchase to EMI, where user can choose the Easy Payment Plan from the given list. There you’ll get option for purchase to EMI. Click on it and you can split your purchase into easy installments of 3,6,9,12,18 and 24 months. Note: This option is only available for purchases made above 5000/- using your canara bank credit card.

4. Different Easy Payment Plans are displayed along with Interest rates, Tenure and the monthly Installment Amount for easy Payback.

5. View Purchase details such as Merchant Name, Invoice Number for EMI plan, City of Purchase and Branch/Location of Purchase.

6. After Clicking on icon, Purchase to EMI is initiated for the transaction and screen is navigated to Purchase to EMI Summary View.

7. Purchase to EMI Summary view displays complete information on a transaction which has been converted to EMI, such as Transaction Date, Request Date, Merchant Name, EMI Amount, Tenor in Months, Interest % charged, Fees Amount Charged, Total amount and Invoice No.

8. Once you complete conversion of bill to EMI, your bill will be reduced and the remaining amount will be adjusted to your available credit limit.

How to Register for Canara Saathi Credit Card Application ?

Follow the below steps to register for the Canara Bank Credit Card application on android and iStore. Know More : How to Install & Download Canara Saathi App ?

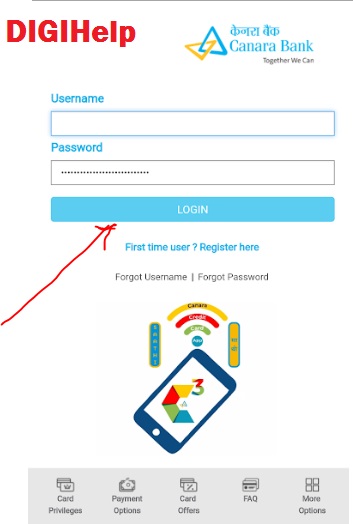

- Open the Canara Saathi app and click on first time user? register here. For Download [Click for Android] [Click for iStore]

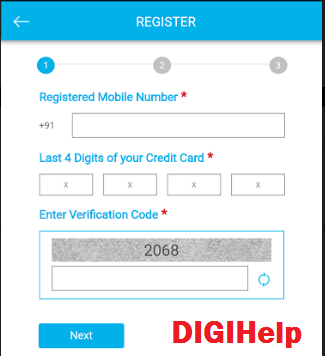

2. Fill the details required on the page. Your registered mobile number (10 digits), last four digits of your credit card and the verification code.

3. You’ll get OTP on your registered mobile number. Insert the same and follow on screen instructions. Soon you’ll get the message as app registered successfully.

4. Then proceed for login. Insert your user name (as provided by you during registration. By default all letter are displayed in CAPS) and password as set by you (Password is case sensitive). If you’re using latest version with fingerprint enabled device, you don’t have to input the password each time you login to the application. Instead you can set your fingerprint as password and the corresponding details will appear automatically. It can be enabled under Setting>>bio-metric tab.

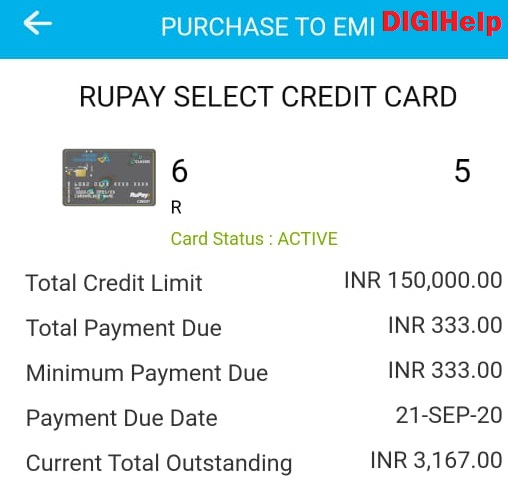

5. Once you login, home page will appear showing your Card status, name, card number and billing details.

6. There are options for viewing last 5 transactions (3), payment of credit card bill (2) and generating credit card statement.

7. Your billed amount will be shown. You can make payment by clicking proceed to pay option. There you can make payment by debit card or net banking of any bank

Canara Bank Credit Card EMI – Customer Care

If there are any problems pertaining to Canara bank credit cards or Canara Saathi, you can reach their customer care at 18004250018 or mail the details to hocancard@canarabank.com