Canara DiYA is an Online Digital bank Account by Canara bank. Create and Open the Full active account online instantly. Get the immediate account number and customer ID with instant fund transfer. The only requirement for the Canara DiYA Digital Account is Aadhaar with OTP.

All the customers or non customers of Syndicate Bank or Canara Bank can open the account online using the Mobile app Canara DiYA or online through web application.

Features of Canara DiYA

An Instant online process using PAN and Aadhaar based OTP to open the Digital Saving Bank account for Individual without visiting the branch. The account opening process is seamless and completely digital. You don’t have to visit the bank branch to open savings account.

Will the Canara DiYA a Zero Balance Account ?

No, the Canara Digital Saving Account will not be a Zero Balance account. The account created online has a minimum average balance. The minimum average balance requirement of the account is Rs.1000 for urban customers and Rs.500 for customers residing in semi-urban and rural areas.

The account will be provided with all the facilities instantly like Internet banking, mobile banking, debit card, cheque book facilities etc.

Individual will be given an option to choose the branch of their choice.

Can I Open Digital Account without PAN card ?

Key Highlights :

You can open Canara Bank account online without PAN card. This makes it easier for people who don’t have PAN to open a bank account online. Without PAN, customers won’t be able to transact beyond Rs.50,000. Also, after the online account opening process is complete, customers need to visit the nearest bank branch to submit Form 60/61.

What will be the Limit on transactions through Digital Account ?

Online Digital Saving Account will be having the transaction limit of Rs.1 lakh in their account and maximum credit transaction of Rs.2 lakh in a financial year as per RBI guidelines.

There is a requirement of full KYC updation within 12 months. Accounts are closed if the full KYC is not completed. The maximum balance that customers can hold at any point in time in their e-KYC account is Rs.1 lakh.

The aggregate of all credits should not exceed Rs.2 Lakhs in a financial year.

Documents required to open Canara DiYA Digital account online

Aadhaar card and PAN card are required to open Canara Bank account online.

Individuals who don’t have PAN card can also open their bank account online post submission of Form 60/61.

How to Open Canara DiYA Account Online ?

An easy step by step process to open Canara Bank Digital Saving Account online. Individual needs to download the DiYA app or can open through web browser.

Step 1: Download the Canara Diya app for Android or click here to start the online account opening process through web browser.

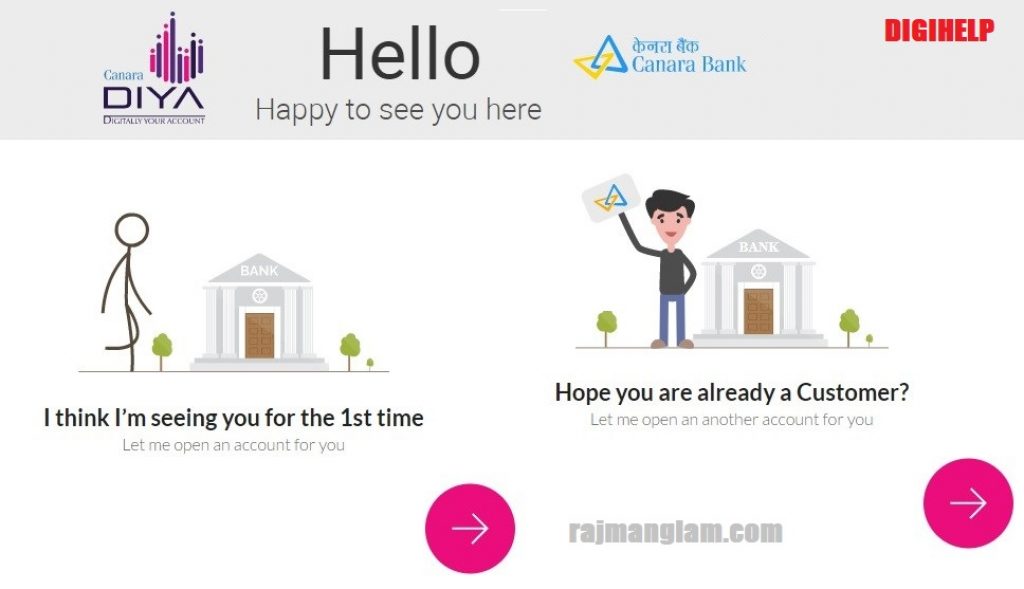

Step 2: If you are opening Canara Bank account for the first time, click on ‘I think I’m seeing you for the 1st time’.

Step 3: Enter your Aadhaar number, agree the terms and conditions and tap on ‘Verify’ to proceed.

Accept the terms and conditions including FATCA declaration which is for an Indian resident citizen, click on ‘I agree’. Enter the OTP that you have received on your registered mobile number.

Step 4: Your basic details including your name, Aadhaar address will be fetched from Aadhaar database.

Step 5: If your communication address is different from Aadhaar address, you can add your communication address.

Step 6: Choose if you want to proceed with your PAN card or without your PAN card. If you don’t have PAN card, click on ‘I don’t have PAN’ and if you have PAN, click on ‘I have PAN’. People who don’t have PAN should submit their form 60 to the nearest bank branch.

If you have PAN, enter your PAN and click on verify to continue.

Step 7: Provide your Passport number, voter id number if available but not mandatory. Add your profession and income.

Step 8: Choose the Digital Banking services opted for like debit card, internet banking etc. Add your father’s name, mother’s name and nominee details. Select your branch, state, search for the nearest bank branch.

Step 9: Add your mobile number and email id to register with the bank account. Enter the OTP that you have received on your mobile number. Click on ‘Open Account’.

Also Read – [Resolved] – Canara Bank PhonePe Not Working ?

Congrats ! Your account is now open and you will receive your account details such as account number and branch on the screen as well as on email and through SMS message.