How To Link Mutual Fund eKYC with Aadhaar ? – Investment in Mutual Fund is now linked with Aadhaar after Income Tax return authentication through Aadhaar . A new concept have been introduced through which eKYC of mutual fund will be authenticate with Aadhaar based online process. This is the initiative towards paperless work under Digital India.

There are lot of benefit which would be seen through this self online process of investment in Mutual Fund,

- This is very time saving and hassle free process especially for working professional

- A paperless Investment

- Real Time and Instant investment

- Minimal fraudulent

- Hassle free process

Process for eKYC Authentication through Aadhaar

Key Highlights : [hide]

There are two separate process for applying or authenticating through online eKYC process i.e. either through the Mutual fund houses directly or through brokerage firm like camsonline

READ : Top Tax Saving ELSS Funds to Invest In 2016

Follow the following instruction to authenticate eKYC directly through Mutual Fund houses

- Provide all the details requested by the AMC or mutual fund companies like PAN Card, Voter Card, Aadhaar card etc

- All these information are accepted under online mode only

- AMC will send all the information provided by you to UIDAI for verification

- After confirmation from UIDAI , PAN Card details will be verified by Income Tax or NSDL

- After getting confirmation from both the department about PAN card and Aadhaar the details will be uploaded by AMC at Online KRA system.

- If any problem in verification at any of the stage the AMC would go for due diligence.

- After successful completion of verification system and updation of Online KRA, One can invest in Mutual fund with purchase of Units.

What are the Document Needed for eKYC Process ?

Document are almost same as it was asked earlier by mutual fund companies like PAN Card, Address proof etc. Only addition have been made i.e. Aadhaar compulsory. This is to remember that the Aadhaar is needed for both new as well as existing customer.

eKYC process through CAMS Online?

Follow the below mentioned process to authenticate the eKYC through camsonline system.

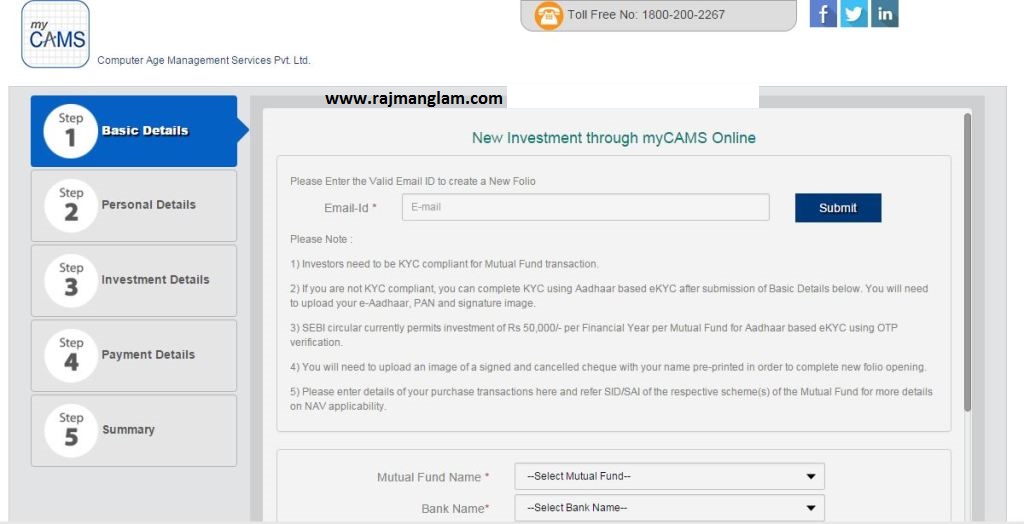

- Visit CAMS online at https://www.camsonline.com/MYCAMS/MCInvestNow.aspx

- Provide your details like email and other basic information to create your portfolio.

- Upload your e-Aadhaar, PAN and Scanned signature.

- Upload the scanned copy of Cancelled personalized cheque duly signed with name printed on the cheque book.

- Investor can invest only up to Rs 50,000/- per financial yesr per mutual fund through this aadhaar based online system using OTP option.

Finally the aadhaar verification would be done at the end :

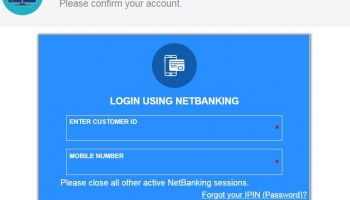

1. After providing Aadhaar details in online mode the screen navigate to UIDAI authenticate screen where one need to provide the PIN code and OTP sent on registered mobile number provided.

2. It is to remember that the registered mobile number will be considered the original number given by you during the Aadhar card opening.

3. After successful verification of OTP , user will be allowed to upload the self attested copy of e-Aadhaar.

KYC application will be verified and OTP will be sent to mobile number and email id registered in the Aadhaar.

Read Also : Top 6 Mutual fund to be invested through SIP

Benefits of eKYC Aadhaar based authentication process

- Moving towards Paperless environment – Digital India Initiative

- Real time and instant results

- No presence of Investor is required

- Elimination of paper verification, movement and storage

- No risk of forged documents

- Protecting Resident privacy and reduction in fraud

- Entire process will be hassle free and easy

Hope facility provided for eKYC will be useful to investors. Do share your views/queries in comment section given below.