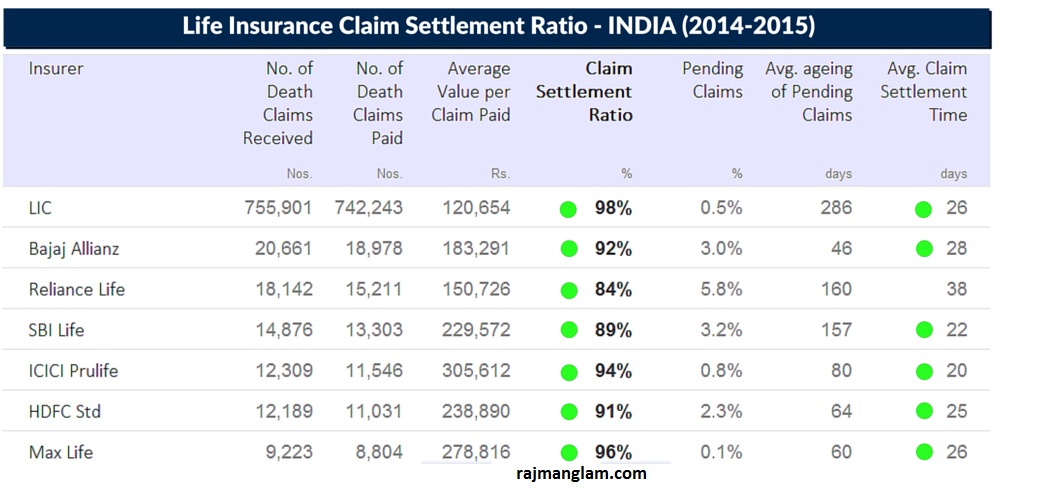

Top Life Insurance Companies in Claim Settlement Ratio as per the IRDA report 2014-15 – The bad part of any life insurance policy is claim settlement ratio. There are many companies which are selling life insurance policies with not very properly defined settlement process and after the death of policy holder %their nominee are denied from paying any claim. In order to aware the investor about the various life insurance policies, IRDA ( Insurance Regulatory and Development Authority of India ) release list of all the companies with Claim Settlement Ratio of all the claim filled and settle within a year.

New list for the Claim Settlement ratio of all the companies are released by IRDA for year 2014-15 mentioning all the insurance companies operating in India.The major highlights and Top Insurance companies as per the claim settlement ratio are listed below. It is advisable to buy the life insurance policies based on claim settlement ratio.

Read Also : How To Claim Multiple Health Insurance ?

Definition Claim Settlement Ration

In simple term Claim settlement ration is define in term of life insurance as number of claims that the insurer has settle following the death of policyholders. Thus, if a life insurer has a claims settlement ratio of 90 percent, it means that the insurer settle and pays 90 out of every 100 claims filed when the policyholder dies.

This is very important as the investment are made for running days afterward the life of policyholder. If claim are not being paid to dependent due to any reason, it will worsen the situation of family.

Based on the above data on Claims Ratio the top companies may be considered for investment, but it should not be only the claim settlement ratio as the reason.

- One may consider the life insurance companies with Claim Settlement Ratio higher than 80% is good enough.

- Consider Average Claim Settlement Time of less than 30 Days

List of Top Companies as per the Claim Settlement Ratio Are :

- LIC with 98% Claim Settlement

- Max Life 96%

- Birla Sun Life 96%

- Star union 94%

- ICICI Pru 94%

HDFC life is having the poorest claim settlement ratio of just 91% compare to above companies. Choose smartly if investing in Life Insurance.