Know the rate of TDS application on cash withdrawal from the Bank account i.e. Current Account, Saving Account or Overdrafts. The TDS is applicable on various slabs of transaction based on the cash withdrawal from the bank account. The law is implemented to all the banks and financial institutions uniformly since July 1, 2020.

This is implemented as per the amendment in section 194-N of the Income-tax Act, 1961. As per the amended law,

1. TDS Slab Rs 20 Lakhs to Rs 1 Crore without three years ITR @2% – if an individual withdraws cash exceeding Rs 20 lakh in an Financial Year from his/her bank account i.e. Current or Savings or Overdrafts and has not filed ITR during the last three financial years then TDS will be levied at the rate of 2 per cent (2%) on the amount of cash withdrawn.

2. TDS Slab More than Rs 1 Crore without three years ITR @5% – If the cash withdrawn exceeds Rs 1 crore in the financial year, then TDS at the rate of 5 per cent (5%) will be applicable on the amount of cash withdrawn in case of the individual who has not filed ITR in the last 3 financial years.

3. TDS Slab More than Rs 1 Crore with three years ITR @2% – TDS of 2% on cash withdrawal is applicable if the amount withdrawn from a bank account exceeds Rs 1 crore in a financial year even if individual has filed ITR.

3. TDS Slab between Rs 20 Lakhs to Rs 1 Crore with three years ITR @0% – No TDS will be deducted if the amount withdrawn from a bank account limit to Rs 1 crore in a financial year, if it has filed ITR.

The law was aimed at discouraging cash transactions and promoting digital transactions.

Calculate TDS on Cash Withdrawal

Key Highlights :

For instance, assume you withdraw Rs 25 lakh cash from your savings account in the FY 2020-21. However, ITR has not been filed by you for any of the three preceding financial years i.e. FY 2019-20, FY2018-19 and FY 2017-18. In such a case, bank will deduct TDS at the rate of 2 per cent on Rs 25 lakh i.e. Rs 50,000 from the amount of cash withdrawn.

Under Section 194-N, a bank, co-operative bank and post office is required to deduct TDS on amount of cash withdrawn if it exceeds the threshold amount i.e. Rs 20 lakh (if no ITR filed for last three years) or Rs 1 crore (if ITR has been filed), as the case maybe.

Also Read – Know TCS Rate on Foreign Remittance, Calculation & Eligible Transactions

How to Check TDS on Cash Withdrawal ?

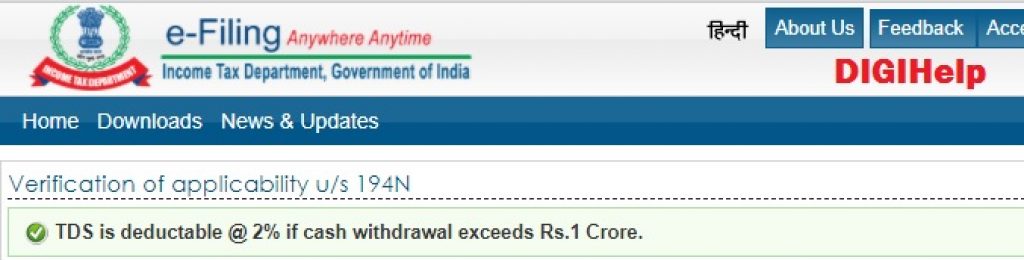

The e-filing website of the income tax department has introduced the facility to check whether the individual has filed ITR for last three financial years or not and the rate of TDS levied on the amount of cash withdrawn.

1. Go to the Income tax India Website link here

2. Enter Your PAN & Mobile Number

3. An OTP will be sent on your registered mobile number

4. Post Successful validation of OTP, the screen will show the rate of TDS applicable under u/s 194N

Tax credit available on the TDS on cash withdrawn

An important thing which must be kept in mind that tax so deducted under section 194N shall not be treated as income of the person withdrawing cash. The Finance (No. 2) Act, 2019 has amended section 198 to provide that sum deducted under section 194N shall not be deemed as income. However, tax so deducted on cash withdrawal can be claimed as credit at the time of filing of ITR.

The Central Board of Direct Taxes (CBDT) in a notification dated September 27, 2019 has allowed the bank account holder (i.e., the individual in whose name the bank account is held) to get tax credit on the TDS but only for the financial year in which it has been cut.