Know the step by step process to submit Form 15G & 15H in SBI online – India’s largest bank State Bank of India (SBI) has enabled the submission of form 15G & 15H through Internet Banking. These forms are filed by individuals whose income is below the taxable threshold. They are usually submitted by taxpayers to banks and financial institutions in April and extended by 30th June for FY 2019-20 under COVID-19.

As per the CBDT guidelines, Banks are mandated to deduct TDS (tax deducted at source) when interest income crosses a certain threshold in a financial year. Basically, Form 15G or Form 15H (for senior citizens) are self-declaration forms to state that his/her income is below the taxable limit. Form 15G and Form 15H (for senior citizens) are submitted by account holders to make sure TDS is not deducted on their income.

Also Read – Who can’t fill the Form 15G or 15H ? Download New Format 15G/15H

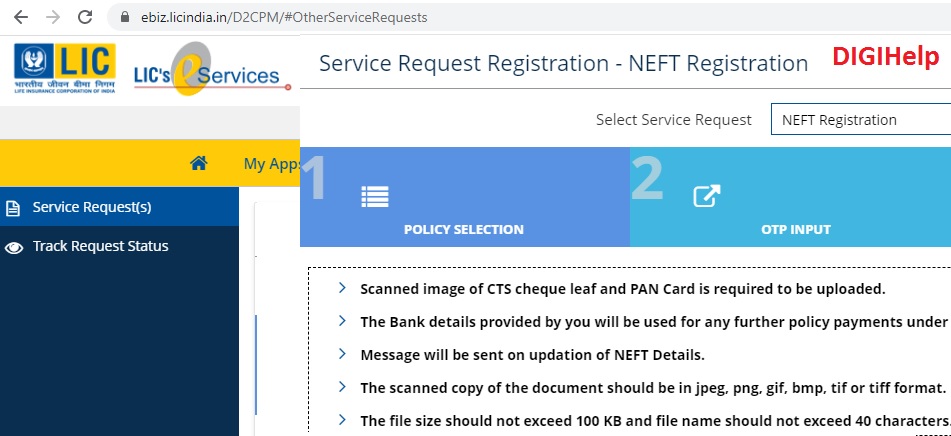

Steps to Submit Form 15G & 15H in SBI Online

– Login to SBI Internet Banking or Click Here

– Under ‘e-services’, select ‘Submit 15G/H’ option.

– Now, Select Form 15G or Form 15H

– Select the Customer Information File (CIF) No and click on Submit.

– After clicking the ‘Submit’button, it will take you to a page which will have some already filled information. Fill up the remaining information.

– Confirm the details

– That’s Done !!