Google Pay Axis Bank ACE Credit Card Review

- 5% Cashback on Bill Payments, 4% on Ola & Swiggy, 2% on all other spends

- 4 complimentary Lounge Access

- 1% Fuel surcharge waiver

- Cashback on wallet load

Axis Bank ACE Credit Card Review – Axis Bank has launched the ‘ACE’ variant of Credit Card in partnership with Google Pay that runs on VISA network. As like Flipkart Axis Bank Credit Card, this card is offering rewards as cashback of 2% to 4% and 5% in case of payment made on Google Pay platform. This card is available on Visa platform in Signature tier and is enabled for contactless payments.

Fees

Key Highlights :

Axis Bank ACE Credit Card comes with following fees:

- Joining fee: Rs. 499 + GST

- Renewal fee: Rs. 499 + GST

Joining fee is reversed upon spending Rs. 10,000 within 45 days of card setup which seems quite reasonable. Renewal fee is also waived off on achieving an annual spend of Rs. 2 Lakhs.

Features & Benefits

Launch Offer

A limited time offer – Enjoy a 5% cashback on Big Basket and Grofers. This offer is valid till 31st December 2020. No Minimum or Maximum limit.

Rewards

5% cashback on bill payments via Google Pay i.e. Electricity, Internet, Gas, DTH, Mobile Recharge, 4% cashback on Swiggy, Zomato and Ola

2% cashback on all other spends i.e. Fuel, Wallet Load, EMI – Giving Cashback on wallet cash load is also a very good benefits.

Cashback earned for the purchases during a billing cycle will be credited in the next billing cycle 3 days prior to the statement generation date. The offering of 5% cashback on bill payment is best in the industry and no other card in the normal course of transaction pay the cashback like it. The default 2% cashback on other spends is simply amazing and it’s highest among entry level credit cards released so far.

Lounge Access

4 complimentary access to domestic lounges per year

Axis Bank ‘ACE’ Credit Card – Other Benefits

- 1% fuel surcharge waiver all transactions between Rs. 400 to Rs. 4,000, maximum up to Rs. 500 per month

- 20% off on partner restaurants participating in Dining Delights Program.

- Convert purchases over Rs. 2,000 to EMI

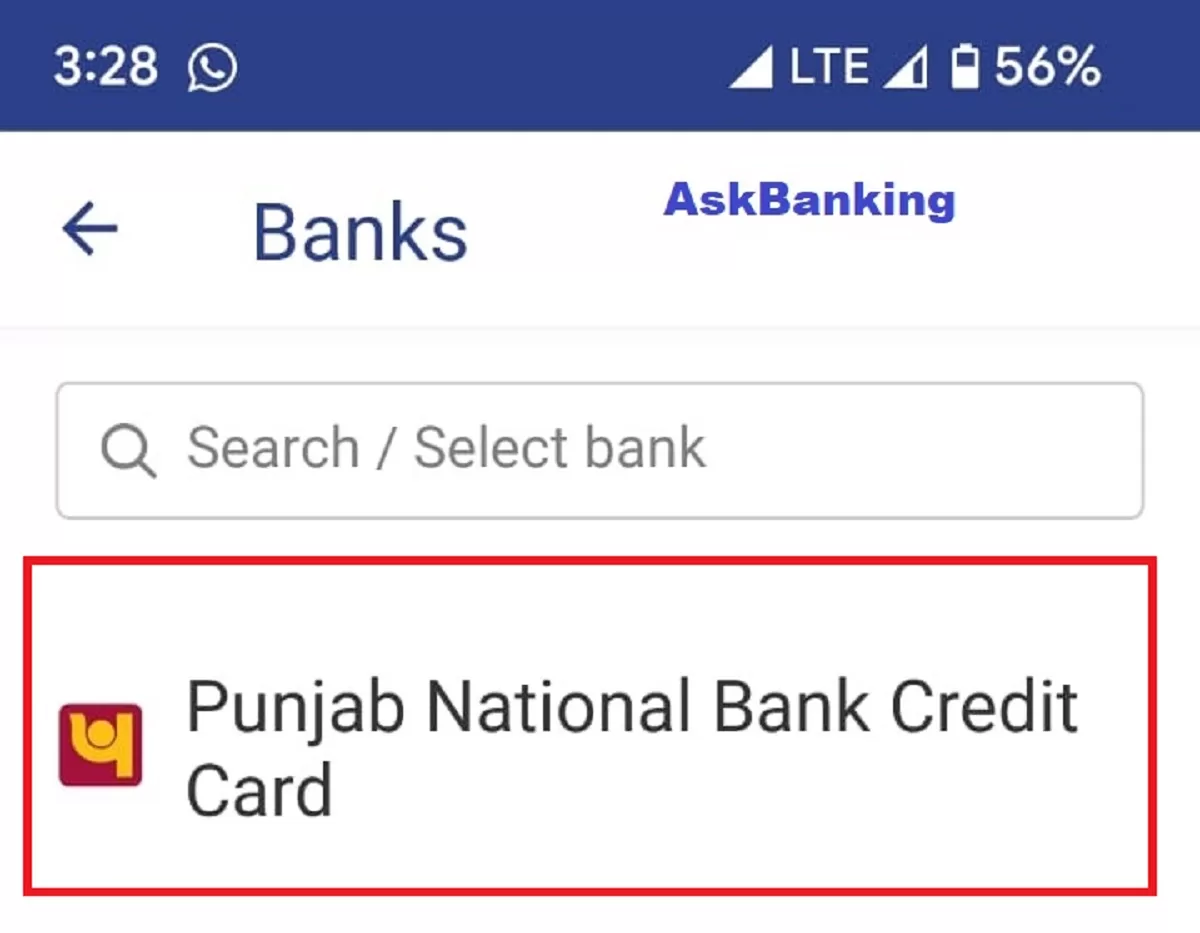

How to Apply ?

Visit the Axis Bank Credit Card section to apply for the Credit Card. Go to the Axis Bank ‘ACE’ Credit Card section and click on this this link for application.

Conclusion

Overall the Axis Bank ACE credit card is among the best card in this fee range. Though, the Axis Bank Flipkart Credit card is also the good one to compete with but the reward rate of 2% makes a difference. No other bank is giving flat 5% cashback on bill payment using Credit Card. Probably in near future, this credit card will give tough fight to popular segment credit cards like HDFC Regalia Credit Card or Yes Premia Cards. A must have Credit Card as of now.

Good for Bill Payments