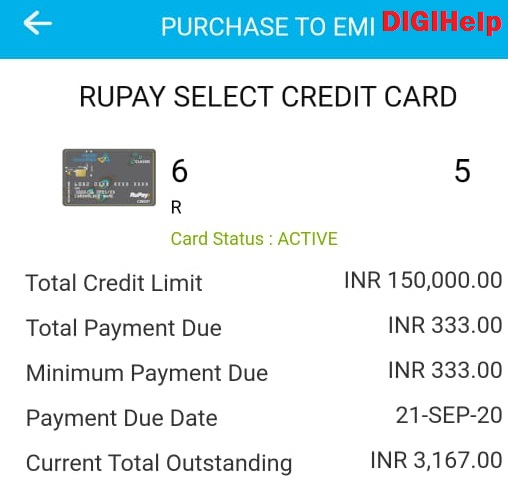

Canara Bank Credit Card Reviews, Features & how to apply – Public sector Canara Bank has introduced the Rupay Select Credit Card with maximum credit limit of 25 Lakhs including host of offers and features. Bank is offering the credit card to all the eligible users through their branches. The existing housing loan, business and high net worth customer may get it easily as it falls under pre approved categories. The overall limit will be fixed on various criteria as like CIBIL score, past credit history, existing loan repayment etc. The erstwhile Syndicate Bank customers can also apply and get the Canara Rupay Select Credit Card.

Canara bank is offering the credit card even against the deposits also. If you are not having any credit history or applying for the credit card first time, you may get it against the deposit. Bank is offering credit card with 75% limit of the deposit. The variant of the card will be different than Rupay Select Credit Card.

Canara Bank is offering Life time free card with no Joining & annual fees but charges for inactivity. It means the holder of the Canara Credit Card must use the card for minimum transactions of Rs 10,000 in a year or there will be a charge of Rs 300 as inactivity fees.

Reward Point – Canara Bank is offering two rewards point for Rs 100 including eCommerce transactions. One Reward Point equivalent to Rs 0.25. Encasement is available for the reward point against the bill.

Also Read – How To Pay Canara Bank Credit Card Bills Online ?

Canara Bank Credit Card Reviews – Fees & Charges

Key Highlights :

| Fees & Charges | Amount |

| Annual Fees | NIL |

| Joining Fees | NIL |

| Inactivity Fees | Rs 300, if the annual minimum transactions is less than Rs 10,000 |

| Cash Withdrawal Fees | 3% of the transaction amount subject to minimum Rs 30 for every Rs 1000 and part thereon |

| Revolving Facility | 2.5% per month |

| Cash Withdrawal Limit | Max. Rs 50,000 per billing cycle |

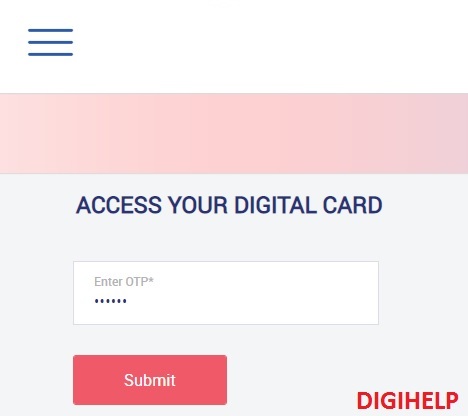

How to apply for Canara Bank Credit Card Online ?

Canara bank is offering the credit card to their existing account holders only. The process for getting the Canara Credit Card is easy. Follow the below steps :

- Visit the Canara Bank Internet Banking & login page with User ID and Password, you may click on link

- After login, go to the Credit Card Apply Online link and submit your interest.

- Done ! You will get the call from the bank for the details and checking the eligibility criteria.

- Alternatively, you may also apply after visiting the home branch where you are already having an account. Syndicate Bank customer may visit their home branch where they hold the saving/SOD/Current/loan account.

- Apply to the branch after filling the application form.

- Post assessment, credit card will be sent on your registered address within 14 days.

Also Read – Credit Card to Bank Account, How to Transfer Fund ?

Canara Bank Credit Card Reviews – Rupay Select Offers

- Complimentary Lounge Access, twice in a Quarter

- Rs 10 lakhs insurance coverage without any Premium

- Various offers as provided by NPCI : Click Here

Customer Care Support – 1800-425-0018