Income Tax Slab Rates For AY 2014-2015 and Financial Year 2013-14 – Income Tax Slabs and rates are changed almost every year. We have provided the latest Income Tax Slabs for Financial Year 2013-14 or Assessment Year 2014-15.

Almost the slabs and rates for Income Tax 2013-14 are similar to previous year i.e. FY 2012-13 except few changes like :

1. Introduction of additional rebate of Rs.2000/- to such Tax payers whose Gross Income doesn’t exceed the Rs 5 lacs ceiling. This is the new chapter introduced in Income Tax rule as per Finance Act, 2013 section 87A of the Income Tax Act, 1961.

2. There is additional surcharge on pension income if exceeds Rs One crore. The amount of surcharge would be 10%.

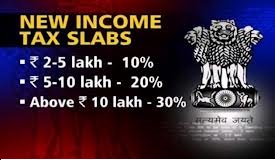

Income Tax Slabs For Individual Resident aged below 60 years

| Income Tax Slabs | Income Tax Rate | |

|---|---|---|

| i. | Where the total income is less than Rs. 2,00,000/-. | NIL |

| ii. | Total Income is between Rs. 2,00,000/- To Rs. 5,00,000/-. | (Total Income -Rs 2,00,000 ) x 10% Less: Rs. 2000/-. |

| iii. | Total income exceeds Rs. 5,00,000/- but less than Rs. 10,00,000/-. | Rs. 30,000/- + 20% of (Total Income – Rs 5,00,000) |

| iv. | Total Income exceeds Rs. 10,00,000/-. | Rs. 130,000/- + 30% of (Total Income – Rs 10,00,000). |

POINT TO BE NOTED :

1. Additional Surcharge of 10% of the Income Tax if total taxable income is more than Rs. 1 crore.

2. Additional surcharge as Education Cess i.e. 3% of the total of Income Tax will be levied

3. This slab is applicable to all Individual up to 60 years of Age, NRI – Non Resident Individual, HUF – Hindu Undivided Family, AOP – Association of Persons, BOI – Body of Individuals and AJP – Artificial Judicial Person

Individual resident with Age Group of 60 years To 80 years

| Income Tax Slabs | Income Tax Rate | |

|---|---|---|

| i. | Gross Total Income Less than Rs. 2,50,000/-. | NIL |

| ii. | Income lies between Rs. 2,50,000/- To Rs. 5,00,000/- | 10% of (Total Income – Rs 2,50,000) |

| iii. | Income Between Rs. 5,00,000/- To Rs. 10,00,000/- | Rs. 25,000/- + 20% of 10% of (Total Income – Rs 5,00,000). |

| iv. | Total income exceeds Rs. 10,00,000/- | Rs. 125,000/- + 30% of 10% of (Total Income – Rs 10,00,000). |

POINT TO BE NOTED :

1. All individual born between 1st April 1934 to 1st April 1954

2. Surcharge of 10% is applicable if total taxable income is more than Rs. 1 crore.

3. Additional Education Cess: 3% on Total Income Tax calculated

Income Tax Slabs For Individual resident of More than 80 years

| Income Tax Slabs | Income Tax Rate | |

|---|---|---|

| i. | Total income Less than Rs. 5,00,000/-. | NIL |

| ii. | Total income between Rs. 5,00,000/- To Rs. 10,00,000/- | 20% of (Total Income – Rs 5,00,000) |

| iii. | Total Income More than Rs. 10,00,000/- | Rs. 100,000/- + 30% of (Total Income – Rs 10,00,000) |

POINT TO REMEMBER : Surcharge and Education Cess applicable

Income Tax Slabs For Co-operative Societies

| Income Tax Slabs | Income Tax Rate | |

|---|---|---|

| i. | Total Income is Less than Rs. 10,000/-. | 10% of the income. |

| ii. | Total Income Lies between Rs. 10,000/- To Rs. 20,000/-. | Rs. 1,000/- + 20% of (Total Income – Rs 10,000) |

| iii. | Total Income More Than Rs. 20,000/- | Rs. 3.000/- + 30% of (Total Income – Rs 20,000). |

POINT TO REMEMBER : Surcharge and Education Cess applicable