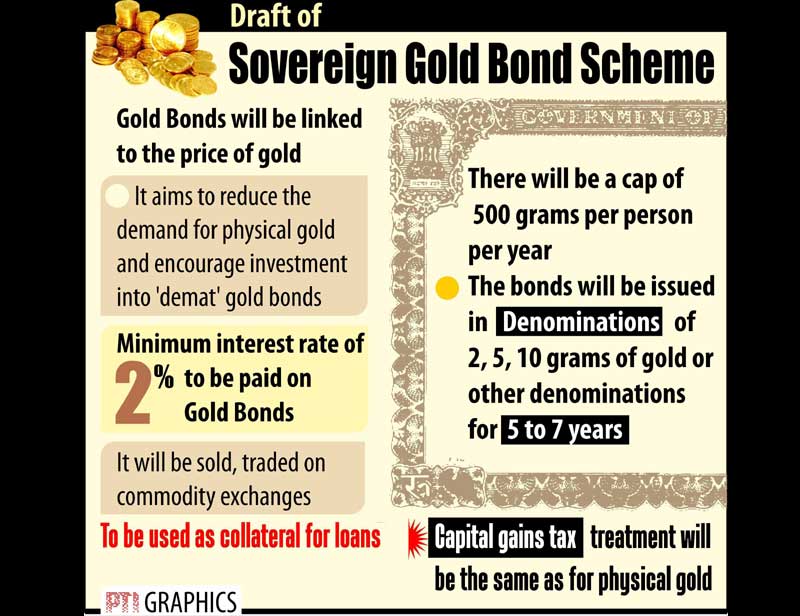

Sovereign Gold Bond Scheme 2015 – This is the scheme launched by Government of India mainly keeping in mind the shifting of 300 tonnes of physical gold purchased every year to Demat Gold Bond format.

What Does Sovereign Gold Bond stands for : When the Gold will be sold in Dmat form instead of physical. This is an option of investing in Gold Bonds instead of buying physical gold. As like you want to purchase a KG of Gold from the shop and instead of giving physical gold they give you the Gold bond equivalent to One KG of Gold.

For An Example : Assume such as you wanted to invest in 2 gram gold bond with tenure of 5 years. Suppose the rate of GOLD is Rs 2400 Per Gram. Your total investment will be Rs 4800. Under this scheme there is a provision of 2% interest per Year and on maturity you would get Rs 6,000 if the market price of gold on that date is Rs 3,000 per gram plus the interest of Rs 120 i.e. 2% of 6000 i.e. 120

Procedure for Purchasing the GOLD BOND

Eligibility Criteria :

Key Highlights :

Sovereign Gold Bonds would be available only for Indian Residents either individually or jointly or in the name of minor as well. Indian Residents includes individuals, HUFs, trusts, universities and charitable institutions. KYC documents such as aadhar card, voter ID card, PAN etc. is mandatory for buying gold bonds. The bonds can be held either in paper form or demat form.

The application can be submitted to the Scheduled Commercial Banks and Post-offices before 20th November, 2015.

Minimum and Maximum Investment

The gold bonds will be denominated in multiples of gram(s) of gold with a basic unit of one gram. The minimum investment in the bonds to be 2 grams with a maximum investment capped at 500 grams per person per fiscal year (April-March). If the investment is made jointly than 500 grams shall be applicable for first applicant.

Issue Price of Bond

Both Issue / Redemption price shall be in Indian Rupee. Issue price of the bond shall be the previous week’s (October 26-30, 2015) simple average closing price for gold of 999 purity, published by the India Bullion and Jewellers Association Ltd. (IBJA).

Currently Issue Price for the first tranche of Gold Bonds is fixed at Rs.2,684 per gram of gold that translates minimum investment of Rs.5,368 and maximum investment up to Rs.13,42,000 /-

Tenure, Redemption and Liquidity

Gold Bonds comes with tenure of eight years but investor can redeem prematurely from the beginning of the fifth year on the interest payment dates. Further, long-term investors can roll over their investments for additional period.

Gold Bonds can also be used to put as collateral for loans and the Loan to value (loan amount) will be equal to ordinary gold loan. In addition, gold bond will be listed in bourses thus can be bought and sold but practically these types of bonds are rarely traded.

Interest Rates

Investment in Sovereign Gold Bonds will fetch interest at the rate of 2.75% per annum. The interest will simple interest not compounded and will be paid half-yearly on the initial investment amount. An investment of Rs.1 lakh would fetch interest of Rs.2,750 per annum totaled to Rs.22,000 in 8 years.

Taxation

Gold Bonds will attract capital gain tax. On maturity, difference between issue price and redemption price will give rise to capital gains and will be taxed as per the holding period. If bonds are sold before holding for 3 years than the gains would be short-term and shall be added to the income and taxed as per slab rate. If bonds are sold after 3 years of holding than gains would be long-term and flat rate of 20% with indexation benefits would apply.

In addition, annual interest on the bonds is fully taxable. The interest shall be added to the total income as income from other sources and taxed as per the slab rate. For the investor falls in 10, 20 and 30 percent tax salbs, the post-tax returns would be 2.47 per cent, 2.18 per cent, 1.9 per cent respectively. However, no TDS shall be deducted on the interest income. The sole responsibility of paying tax on the interest income is on the investor only.

What are the Advantage of issuing the GOLD BOND :

- Government Import bill be reduced as India is the largest consumer of Gold in the world.

- The purity of Gold will be purchased

- This can be used as a Collateral security by lender and buyers

What are the Disadvantage of Gold Bond :

- There are chances of Upside and downside in Investment

- Taxation on Investment

- Physical Gold not handed over