MCLR Rate of Different Bank From 01st April 2016 – The regime of new lending system in Indian Banking System started from 01st April 2016. New Interest rate system i.e. Marginal Cost of Fund Based Lending Rate (MCLR) which will replace the existing Base Rate lending system which was running since July 2010.

Read : [highlight]How to Get Car Loan Easily from Bank?[/highlight]

MCLR is the interest rate which will be linked to RBI Policy rate below which a bank can’t lend to customers. MCLR rate will be calculated by using the cost incurred on incremental deposits, not average cost of deposits.(In Base Rate system). Under this new MCLR Interest rate structure the benefit to borrower in case of transmission of cuts in policy rates to the end-borrowers will be immediate.

Read : [highlight]How To Apply for MUDRA Loan with Banks ?[/highlight]

What is Reset Period ?

A reset period in MCLR means that the interest charged on the loan account will remain fixed for that period for the borrower with option to revise after that period. The actual rate of borrowing for customer will be worked out after adding the risk premium margin to MCLR.

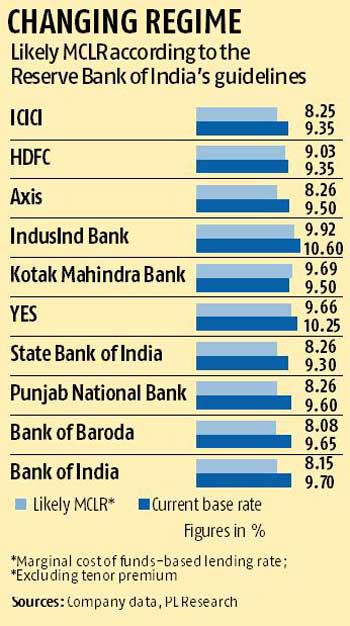

Under this MCLR Reserve Bank had asked banks to price fixed rate loans of up to three years based on their marginal cost of fund from April 1. The List of Bank Along with their MCLR Rates are :

| Name of the Bank | MCLR Overnight rate | One Month | Three Months | Six Month MCLR | One Yr MCLR | Two Yrs MCLR | Three Yrs MCLR |

| SBI | 8.95% | 9.05% | 9.10% | 9.15% | 9.20% | 9.30% | 9.35% |

| PNB | 9.40 | 9.55 | |||||

| BOB | 9 | 9 | 9.05 | 9.10 | 9.30 | 9.35 | 9.35 |

| SBBJ | 9.50 | 9.60 | 9.70 | ||||

| HDFC | 8.95 | 9.05 | 9.10 | 9.15 | 9.20 | 9.30 | 9.35 |

| BOI | |||||||

| Syndicate Bank | |||||||

| Canara Bank | |||||||

| ICICI Bank |