How To Calculate Your Gratuity ? – Gratuity is the salary component paid to the employees by the establishment which are fall under gratuity act. As per new gratuity law each and every employees who had worked for more than five years with an organization are eligible for paying the gratuity. Currently the maximum gratuity paid to the employees are subject to Rs ten lakhs.

This is also to be remembered that the gratuity paid is exempted under Income Tax rule. Read Whether Gratuity Taxable

Eligibility for Getting Gratuity

All the employees following the below mentioned criteria

- An employee must have worked for more than 5 years continuous service with establishment

- Gratuity benefit is payable up to Maximum Rs 10 lacs or less which ever is applicable.

- This benefit is not applicable if employment is terminated due to disability or due to death. In case of death, this benefit is payable to the nominee or legal heir.

- The time limit is 30 days of gratuity becoming payable.

Component of Salary Considered for Gratuity

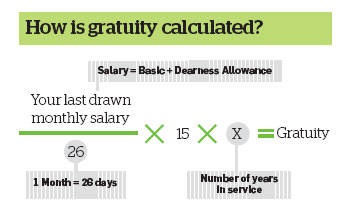

Basic Pay and Dearness allowance along with the length of service is considered for calculating the Gratuity. The length of service considered is always in round figures. i.e. if any one having the length of service as 5 Years 6 Month , the service considered for calculation is 6 years and if it is 5 years and 5 months , length of service considered as 5 years.

Formula of Gratuity Calculation

There is a universal formula for Gratuity Calculation i.e.

This is to remember that Gratuity calculation for Daily laborer are calculated on one day salary i.e. average daily wage of last 90 days